A couple of months ago a friend of mine asked me why I thought buying a house was such a bad idea, and I responded with an email outlining my thoughts. Now whenever someone asks me what I think about buying a house, I just forward them that email. This blog post is basically a cleaned up version of that email with advice that is slightly more generalized.

Conventional wisdom seems to be that buying a house is a good financial decision because:

1: With a house, instead of just giving money to a landlord, you’re building equity.

2: Housing prices generally go up, so you’re likely to make money on your house in addition to the equity you already built up.

Point 1 is incredibly misleading. In my case, the initial breakdown of my $1359.42 mortgage payment with 5% interest (which wasn’t bad at the time) was:

- $943.50 – Principal and Interest

- $78.64 – PMI (In 2009, when I bought, you could avoid this if you put 20% down. It can also be higher — a friend of mine refinanced his mortgage, and his PMI somehow went up to $300/month on a smaller mortgage than mine)

- $291.36 – Property Taxes

- $45.92 – Homeowner’s Insurance

Of that $943.50, I think roughly $250 was principal, and the rest was interest. This is due to something called a mortgage amortization schedule, which is a fancy way of saying the bank will make you pay mostly interest at the beginning of the loan and mostly principal at the end, which is great for the bank but not so great for you. So if you sell 4 years after you bought (like I did), you’ve spent $65K on mortgage payments, but you’ve only built $13K in equity. I sold my house for $189,000, which meant that 6% ($11,400) of that equity went to a realtor, and I got to keep the rest (and the $10K minus expenses I made on my house after performing substantial renovations — more on that later.) With that said, if you hold onto your mortgage for a long time, the mortgage amortization schedule will start working for you instead of against you, and point 1 starts to become more valid (although still misleading). If I had to do it all over again, I would have done a 15 year mortgage, but that’s an entirely different blog post.

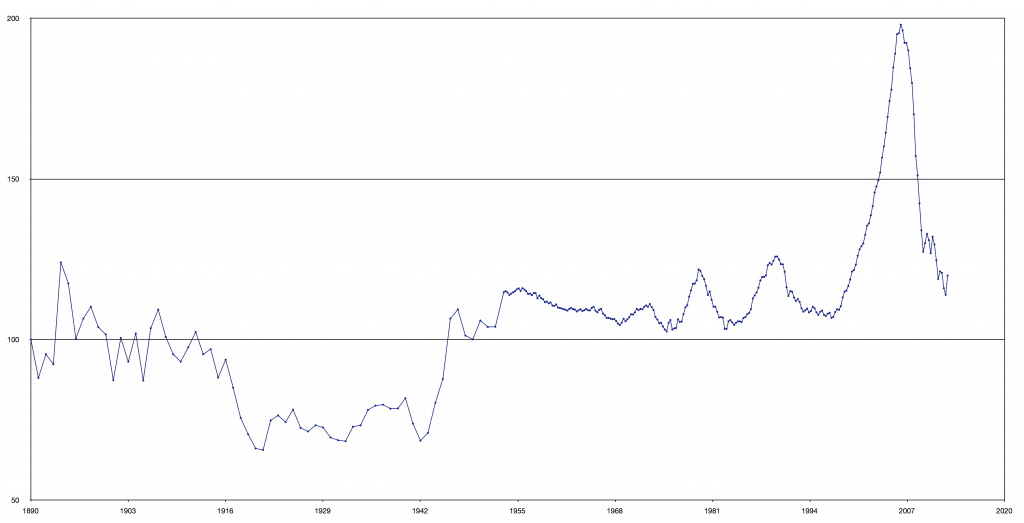

Point 2 is true for anyone who owned a house during the housing bubble, but false for everyone else. I think over the last hundred years, the average house has increased in value like 0.3% relative to inflation or something. The Case-Shiller index does a great job of illustrating this (the image below is taken from Wikipedia):

You’ll notice that there’s quite a bit of fluctuation in the housing market — it’s even more extreme locally. Which brings me to my next point — selling a house is expensive. As I learned, if you sell a house 4 years after you buy it, it is likely that all the equity you built up will go to your friendly real estate agent. After that, your profit (or loss) is entirely determined by whatever the short-term housing market decides to do. If the value of my house (with renovations) had gone down 10% from 2009, I would have had to choose between not moving, getting foreclosed on, or spending $18K for the privilege of moving.

Another way of saying what I just said is that the cost of selling a house is inversely proportional to how long you have lived there. I think most people argue that you need to plan on living in a house for at least 5 years in order for it to make sense, and I’d argue that is probably right. I don’t know what your circumstances are, but the probability of someone in their late 20s wanting to move in ~5 years is probably higher than any other demographic. Maybe you guys will have kids or something. Or maybe you’ll get a sweet job offer in another city. I don’t know. That’s the primary reason I don’t want to own a house — I’d feel trapped. I don’t want to feel trapped at this point in my life.

In addition to all the money you’re spending on your mortgage, you’re probably going to spend a lot of money maintaining your home. It depends on the home, but it will likely be measured in hundreds of dollars per month. Stuff around the house always breaks. At my last house, I had to replace the furnace, several kitchen appliances, a couple windows, and all the carpet. I think I repainted every room in the house and fixed up a bathroom. I’m sure I did a bunch of other stuff too which I fortunately can’t remember right now.

That’s another point worth emphasizing. Not only do I think a house is a bad place to invest your money, it’s a bad place to invest your time. Stuff breaks all the time, it sucks, and you get to spend your time and money fixing it (or spend even more money to hire a contractor). Just last weekend, the washing machine in our rented house broke through no fault of our own. Our landlord got to fix it — and instead of spending my Saturday fixing a washing machine, I got to read a book.

Of course, renting has its costs too. Usually if you rent a house, your monthly payment will be slightly higher than if you buy a house. In our case, based off the Zillow value of the house we’re renting, we’re paying a roughly $200/month premium to rent. This will probably pay for itself just in terms of the maintenance we don’t have to do, plus we get all the added benefits of renting. Of course, the rent is probably going to go up every year, which would be a huge problem if we planned on living here for a long time, but we don’t, so it’s hopefully it won’t be a big problem. Of course, every market is different, so what’s true in one city right now might not necessarily be true in another city.

TL/DR: I think buying a house is a huge financial mistake unless you plan on staying put for a long time.

Blog

Blog